1. What Is a Cheque Number?

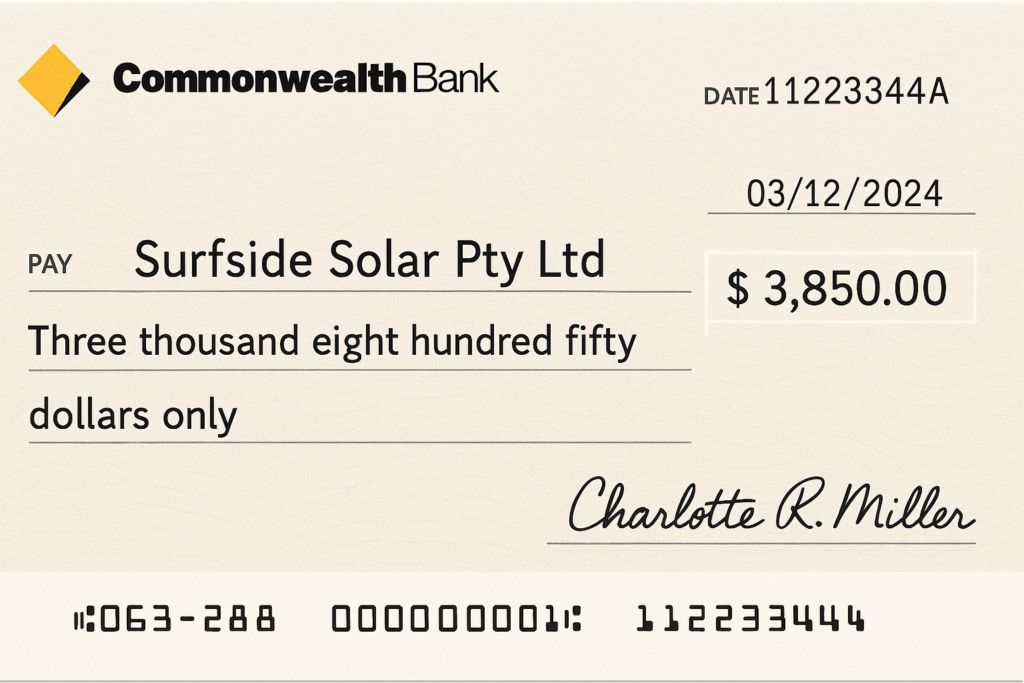

Cheque number is a combination of digits which are printed on each cheque. It assists banks and individuals in monitoring and detecting every cheque with ease. This figure would be located either on the bottom or top right side of the cheque.

When you write a cheque, you and your bank know which number cheque had been used to make the payment. It is like an ID for the cheque. Learning the cheque number will ensure that your pay is in order and will not cause confusion.

The cheque number comes in handy in case you misplace a cheque or in case you need a check whether the cheque is cashed or not. Each cheque of a cheque book has a different number which increases sequentially.

2. Location of the cheque number?

Cheques are printed with the number of the cheque. In most cases, it is displayed at the upper right hand corner. Also there is another location in the bottom along with the bank branch code and account number.

It is not a large number but quite significant in tracking. As you see your cheque book, you will see that these figures increase by one with every cheque. This will assist you in knowing the number of cheques that you have used and the number that remain.

This number is used by banks so that they can document payments to prevent errors. It is easy to manage your money knowing what a cheque number is and where to locate it.

3. The Importance of the Cheque Number.

Cheque numbers have a great number of reasons. It assists the banks in monitoring all cheques that you write. In case of any issue with a payment, a cheque number will be used to locate the cheque.

You are also able to maintain a record of your spending. You can write on the cheque the cheque number on your register. In this manner, you are aware of payments made and the pending payments.

The cheque number helps in confusion as you will have a lot of cheques. The knowledge of cheque number will put you in charge of your bank and prevent errors.

4. What is the role of Cheque Number in Banking?

When one provides a cheque to another the cheque number is used by the bank to forward it. Bank systems record the number as an indication that the cheque has been utilised. In case one attempts to use the same cheque, the bank will be aware due to the number of the cheque.

It protects you from fraud. The bank also matches the cheque with your account by the cheque number. It guarantees that the right person is paid the right amount. Money Banks The cheque numbers are numbers used by banks to classify transactions and hold your money.

Being aware of what a cheque number is makes you realize how fraud and other mistakes by banks are avoided.

5. Cheque Number/Account Number Difference

You have a cheque number and this is not the same as your bank account number. The cheque number is used to find out the cheque you are using. You have an account number that is used to identify your entire bank account.

The cheques would have the same account number. With each cheque, the cheque number varies and it assists in the tracking of the individual payments. They both are significant but work in different organizations.

You do not have to write the cheque number when you are writing a cheque but it is already printed. But you cannot but write the right name of the payee and right amount. Knowing the difference will make you manage your cheque book properly and not be confused.

6. How to Monitor Your Cheque Numbers.

You should remember to record the cheque numbers that you use. Cheque number can be written in a cheque register or notebook. Record the amount paid, payee and the date as well.

This will assist in understanding which cheques were drawn and which are still left. Tracking ensures that errors such as writing a cheque twice or losing your money are avoided. There are also banks where cheque numbers are displayed in your bank statement online.

It is so easy to check up on your payments. The ability to know cheque number and monitor it can assist you to spend your money wisely and not get into trouble with the bank.

7. What Will Happen When You Use the Cheque Number twice?

Similar cheque number may give trouble. The second cheque might be evaded by the banks due to its appearance as a copy. This may postpone the payments or misunderstand. It can also cause a red flag in terms of fraud and your bank will freeze your account due to security reasons.

To prevent this, ensure that you use cheques in sequence by keeping a record of the cheque number. In case of losing cheques, report your bank so that no misuse is done.

Knowing a cheque number also makes you sure that you do not use the same cheque number twice and also, protects your account.

8. Is it possible to alter the cheque number?

No, it is impossible to change the cheque number. The bank prints it and affixes it on the cheque. This is a significant figure on the bank records and security. Attempts at altering or obliterating the number on the cheque are unlawful and liable to dire consequences.

A cheque should be always used as it is and the right details should be entered in the payee name and amount. In case an envelope is lost, request your bank to issue you with a new cheque book.

It is as much as you know the cheque number because you want to respect the banking rules and not get into trouble.

9. Electronic Alternatives to Cheques Numbers.

Nowadays, digital payments are used by many individuals, no longer through cheques when it comes to banking. But even the digital transactions possess singular ID numbers such as cheque numbers.

These assist in keeping track of payments and record keeping. Mobile banking applications and web banking display transaction figures on every payment. These numbers are used like cheque numbers and they assist you to manage your money safely.

Although the use of cheques is still popular, online processes are quicker and safer. The knowledge about the cheque number will make you realize how paper and electronic banking ensure the safety and order of money.

10.Cheque Number Basics

| Term | Meaning | Importance | Example |

| Cheque Number | Unique number on each cheque | Helps track and identify each cheque | Number on top right of cheque |

| Account Number | Your bank account’s unique ID | Identifies your whole bank account | Printed at bottom of cheque |

| Payee | Person or company who gets the money | Shows who will receive the payment | Name written on cheque |

| Duplicate Use | Using the same cheque number twice | Causes payment problems and fraud risk | Avoid writing same cheque twice |

| Digital Transaction ID | Unique number for online payments | Tracks digital transactions | Number shown in bank app |

Conclusion

Cheque number is a unique number that helps you and your bank to track the cheque that you use. It is a significant aspect of banking since it ensures that all payments are distinct and can be located.

Being aware of cheque number can be used to take care of your cheque book, so that you can be able to prevent some of the errors one can make such as using the same cheque twice.

The number of cheques still finds a use in the safe and well-organized banking even with the increased number of digital payments. With the knowledge of cheque numbers, you will be able to manage your money securely and smoothly without any problems in your transactions.

FAQs

Q1: What is the purpose of cheque number?

Cheque number is used to identify a cheque and record the payments in your bank account.

Q2: What is the number of cheques?

The cheque number is printed on the bottom or the top right hand side of the cheque.

Q3: Is it possible to write on the cheque number?

No, the bank fixes and prints the number of the cheque. Changing it is not allowed.

Q4: What will occur in case I use same cheque number twice?

The use of a given number of cheques twice can lead to difficulties in making payments and raise the risk of the bank suspecting fraud.

Q5: Does the cheque number match that of the account number?

No, the cheque number does not match the bank account number. Cheque number identifies the cheques and account number identifies the entire bank account.